Celebrating 15 Years: Play & Market

Where Game Development Meets Trading Precision. Since 2009, Dilallay has pioneered the fusion of interactive entertainment and financial algorithms, creating a unique ecosystem for strategic thinking.

The Candle Philosophy

Igniting Creativity, One Trade at a Time

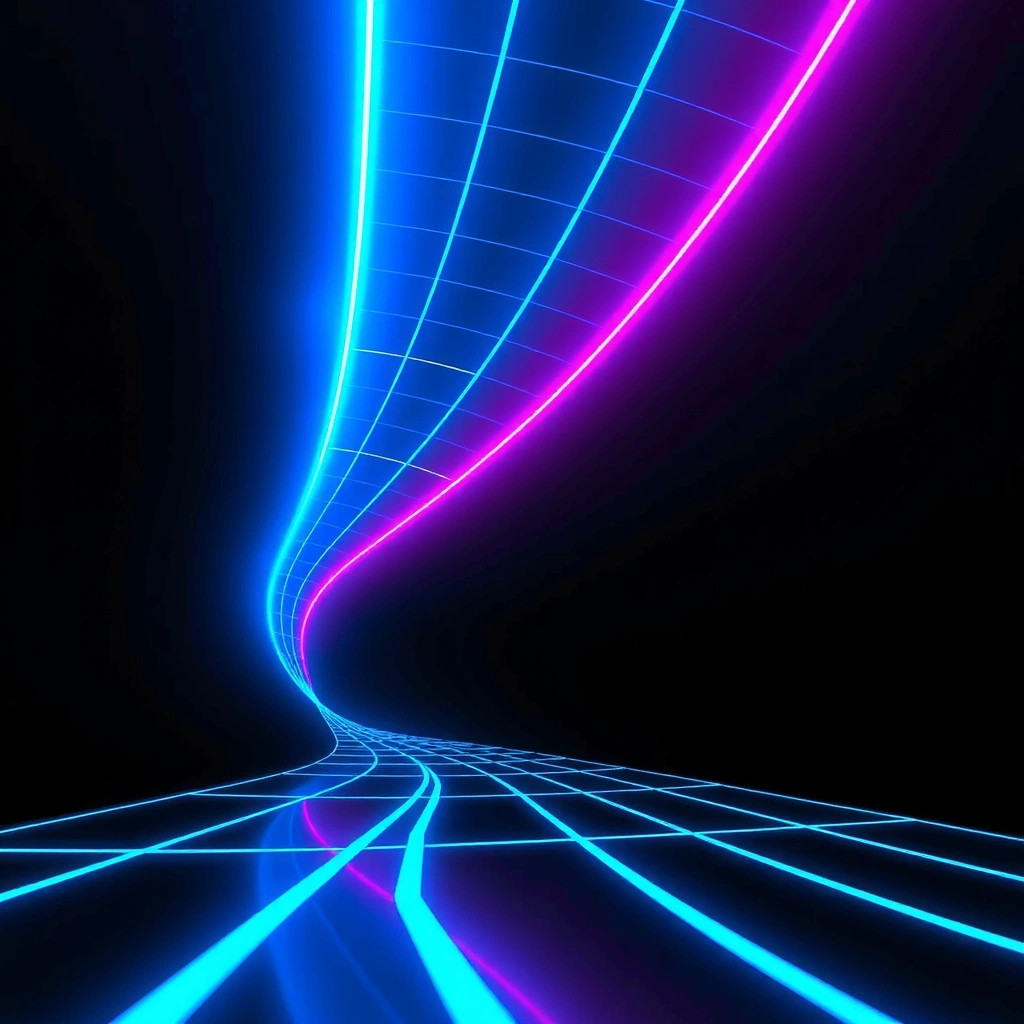

Trading Visualizer

Market Volatility Module

Adjust the volatility slider to see real-time risk state changes in the game level wireframe.

Guide: Values 0-32 (Low Risk) = Stable green state. 33-66 (Mid Risk) = Warning amber state. 67-100 (High Risk) = Critical red state. This module simulates real-time asset allocation risk in game economy design.

2399$ Value - 100% Free

To celebrate our 15th anniversary, we're unlocking the complete Dilallay Premium tier. Access our proprietary trading algorithm visualization engine, cross-platform SDK, and market analysis tools without restrictions. This is the exact same technology stack we use internally for game development and financial modeling.

- ✓ Unlocked Features: Full source access

- ✓ No Restrictions: Commercial use allowed

- ✓ Lifetime Access: No subscription fees

- ✓ Priority Support: Direct developer access

Valid only for new registrations during Q1 2026

Universal Platform Integration

Dilallay Field Guide

Understanding the fusion of game development and algorithmic trading requires a new vocabulary. This guide decodes the core concepts that power our engine and explains how financial principles influence level design mechanics.

At Dilallay, we treat every game mechanic as a micro-economy. Risk assessment isn't just for traders—it's the foundation of engaging difficulty curves. Our proprietary model translates volatility indices directly into enemy spawn rates, resource scarcity, and reward multipliers.

Decision Criteria

- • Volatility Index (VI): Determines the variance in enemy behavior. High VI = unpredictable AI patterns.

- • Liquidity Score: Measures resource flow rate. Affects crafting and upgrade availability.

- • Momentum Factor: Tracks player progression speed. Used to balance difficulty spikes.

- • Market Correlation: How closely in-game economy mirrors real-world asset movement.

Myth vs. Reality

Myth: "Trading mechanics make games too complex."

Fact: Properly integrated, they create deeper strategic layers without overwhelming casual players.

Key Terms

- Slippage: Difference between expected and actual reward.

- Yield Farming: Passive resource generation mechanics.

- Derivative: Secondary game modes based on core mechanics.

Common Mistakes

- • Ignoring liquidity constraints in rewards.

- • Using static volatility curves.

- • Forgetting correlation bounds.

Implementation

Start with low volatility settings (0-30) for tutorial zones. Increase gradually as player mastery grows. Always provide clear feedback on risk state changes.

Contact Dilallay

Questions about our 15th anniversary offer or need technical details on the engine? Our team in South Korea is ready to assist.

Company: Dilallay

Address: Banpo-daero 282, Suwon, South Korea

Phone: +82 10-6104-2075

Email: info@dilallay.com

Hours: Mon-Fri: 9:00-18:00

Quick Inquiry

By contacting us, you agree to our Terms of Service and Privacy Policy.